AirDNA’s Airbnb Rentalizer and Other Tools for Estimating Rental Income (A Detailed Guide)

Learn to estimate rental income using tools like AirDNA and Mashvisor. This detailed guide helps short-term rental investors maximize their revenue with data-driven insights.

A data-driven approach can guide you to make smarter investment decisions. Before investing in short-term rentals, consider using tools like AirDNA or Mashvisor. Their revenue calculators can help you estimate a property’s profitability.

These tools are valuable for both first-time Airbnb investors and seasoned hosts looking to increase their revenue. Remember, each market is unique. To stay ahead in your business, you’ll need to understand your competitors’ performance and create accurate revenue forecasts.

Let’s explore how to do this effectively.

How do I Calculate Income Using Airbnb Calculators?

Leverage specialized financial calculators and market analysis tools to optimize your rental business. While we discuss paid tools, many also have free or freemium versions. Later in this guide, we’ll spotlight top tools and their unique advantages. Airbnb estimators are indispensable for maximizing rental income for real estate investors, vacation rental managers, and Airbnb hosts.

How to Choose the Best Airbnb Analyzer?

Airbnb Rentalizer by AirDNA is one of the tools that helps hosts and investors estimate potential Airbnb revenue, daily rates, and occupancy. It collects and analyzes data from hundreds (and thousands) of short-term rentals in your market to provide accurate insights. However, there are other tools as well.

How do you choose the best one for you?

Key Features to Consider

Make sure to understand where the tool sources its data and whether it’s up-to-date. Consider a calculator that offers features such as:

- Occupancy rate analysis

- Annual revenue estimation and future booking predictions

- Airbnb rental comps (comparing your listing to similar listings in the area)

- Investement Analyisis

- Pricing recommendations

Great calculators estimate cleaning fees, occupancy rates, average daily rates, and annual revenue by factoring in seasonality, location, historical data from Airbnb and other platforms, and available amenities.

Where Do Airbnb Calculators Collect Data From?

By analyzing large volumes of short-term rental data, calculators estimate your potential Airbnb income. But where does this data come from?

All companies disclose their data sources. For example, AirDNA sources its data from Airbnb, Vrbo, and property management tools they partner with. Mashvisor uses Airbnb, the MLS, and public records as data points. (Note that Mashvisor is available for the US market only; we’ll discuss this later.)

How Accurate Are Tools like AirDNA Rentilizer?

The effectiveness of each of these tools largely depends on the accuracy of the data they use. AirDNA claims to be 96.2% accurate in predicting earned revenue, though investors and hosts sometimes report occasional over- or underestimations.

What can certainly help is becoming informed about how to use the software and interpret the data. Continue reading for expert tips on analyzing your short-term rental properties accurately.

Airbnb Market Research and Analysis

Have you ever read dozens of reviews before buying a new gadget? Sometimes we obsess over it because we want to make sure our purchase pays off and we get the most bang for our buck. Apply the same level of diligence when evaluating houses and vacation rentals.

If you watch closely enough and long enough, you’ll start understanding what factors drive profitability in a market. It could be a particular amenity, a backyard view, or proximity to a location. Data-driven tools give you deep market insight into what you can expect in terms of numbers, and if you’re skillful enough to read data, tools will show you how to outperform the competition.

Pro tip: Weed out non-active listings with few or no recent reviews to get an accurate picture of the market.

Analyzing Earnings and Profit

The shortcut to success in the Airbnb business is checking the occupancy rate, annual income, and nightly rates of active properties in your area. By entering property details, investment information like down payment, mortgage details, and monthly expenses into the calculator, you can estimate future earnings.

Keep in mind that some calculators, such as AirDNA’s Rentalizer, estimate gross revenue (including cleaning fees). To get the full picture, these calculators also show the net operating income, operating expenses, and real estate metrics like cap rate.

Optimize Pricing Strategy and Maximize Occupancy Rate of Your Vacation Rentals

Airbnb revenue estimators inform you about seasonal highs and lows. Knowing what competitors charge and when helps you optimize pricing strategies. AirDNA even provides dynamic pricing recommendations based on current market conditions, similar property performances, and demand trends.

Moreover, you’ll understand the average minimum stay and how prices change throughout the year. Sure, you can check prices on Airbnb directly, but it would be daunting to go back and calculate revenue for each property manually. These tools give you forecasts and pricing recommendations based on historical data.

How to Use AirDNA Rentalizer

To effectively use this tool, focus on these key features and metrics. Let’s break them down.

Start-up and Operational costs

Rentilizar considers startup costs such as property price, furnishings, closing costs, and operational expenses in its financial calculator. This feature is especially valuable to investors for gauging net profit.

Comparable Rentals

Comps are rental properties you’re competing against, such as similar types of properties in the area. Often, you’ll need to filter out comparable listings that appear on the list but are not relevant or active. Experts typically distinguish between two types of comparable properties: a base comparable, which is easy to compete with in terms of revenue, and a top comparable, which is significantly above your level.

Annual Revenue

AirDNA displays both the annual revenue and potential revenue, which estimates what the revenue would be if the listing were active year-round. Pay attention to the “Days Available” metric, which shows how many days the listing has been tracked. To ensure data accurately reflects seasonal patterns, it is essential to focus on listings that have been tracked for the entire year or at least a significant portion of it.

Average Daily Rate

Based on market insights, Rentalizer displays the average daily rate (ADR) of each listing and predicts the ADR for the next year.

Seasonal Revenue Forecast

AirDNA provides a 12-month forecast based on the performance of comparable rentals over the last 12 months. This forecast includes changes in seasonality and revenue fluctuations resulting from it.

Submarkets

As a paid subscriber, you can analyze submarkets—local neighborhoods and smaller areas. This feature lets you drill down into specific regions, compare different submarkets, and identify the best areas for investment. It also helps you understand localized trends and tailor your pricing strategy to neighborhood-specific demand.

Smart Rates

AirDNA’s dynamic pricing feature, called Smart Rates, automatically suggests nightly rates based on market fluctuations. It also allows for manual adjustments to fit your goals, whether you aim to maximize occupancy or achieve the highest possible rates. According to their website, Smart Rates has been proven to increase annual revenue by up to 24%.

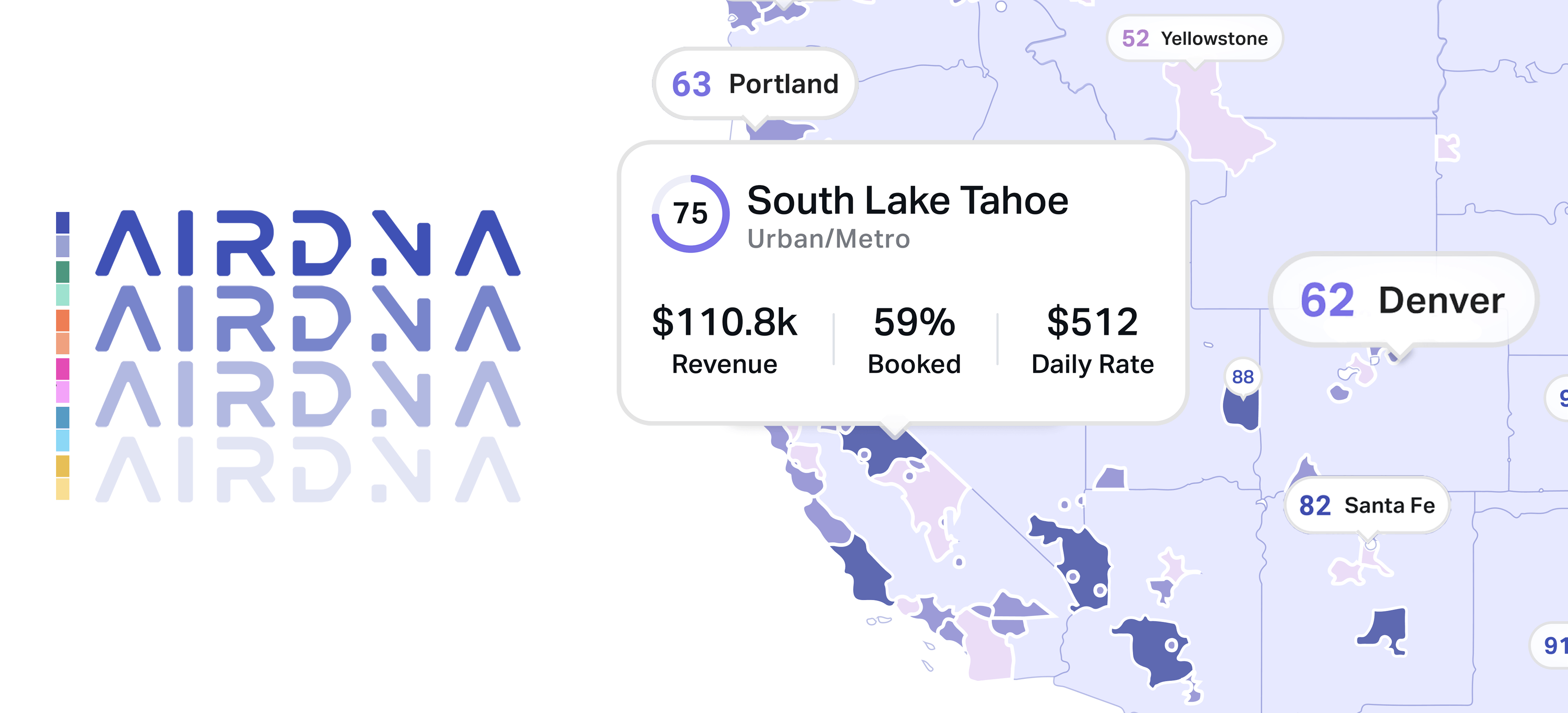

Market Grade

A metric that evaluates market demand and growth potential, AirDNA’s Metric Grade scoring scale ranges from A+ (94-100) to F (0-9). This score helps you visualize the market’s potential.

AirDNA Alternatives Worth Considering

In addition to AirDNA, which has become an industry leader, there are several other alternatives worth your attention, including Mashvisor, Airbtics, Rabbu, Alltherooms, and STR Insights.

Mashvisor

This Airbnb investment calculator is designed for real estate investors interested in identifying and analyzing profitable rental properties. Mashvisor incorporates data from Airbnb, MLS, and public records.

It is perfect for those who want to conduct thorough market research, evaluate investment opportunities based on comprehensive data and properties on sale, and make informed decisions.

Compared to AirDNA, which is available globally, Mashvisor is only available in the U.S. market. Some of its key features include:

- Investment Property Search: Find properties for sale in any U.S. market.

- Real Estate Heatmap: A visual tool to identify the best neighborhoods for vacation rentals based on metrics like rental income, occupancy rate, and cash-on-cash return.

- Airbnb Profit Calculator: Provides detailed financial metrics, including a 10-year investment payback balance.

- Airbnb Laws and Regulations: Information by city to help investors ensure they operate legally.

Airbitcs

Airbtics is another global market tool similar to AirDNA. Its Airbnb calculator is comparable to AirDNA’s Rentalizer.

Key features include:

- Market Analysis Tools: Insights into revenue potential, occupancy rates, and nightly rates.

- Property Analysis Tool: Evaluates individual properties based on address, size, and amenities.

Airbtics estimates revenue projections, comps, and more. Compared to AirDNA, it offers somewhat less detailed reports. However, it provides dynamic insights, updates its database daily, and covers the worldwide market.

Rabbu

Rabbu is known for its completely free Airbnb calculator, which helps users crunch numbers and analyze market seasonality. The platform is designed to assist real estate investors in buying, and selling short-term rental properties. The built-in Airbnb Calculator provides key metrics such as sales price, revenue, cap rate, gross yield, and cash-on-cash return.

While it has received some mixed reviews regarding accuracy, it’s worth checking out, especially given that it’s free. Keep in mind that no tool can offer 100% accuracy.

Alltherooms

More affordable compared to AirDNA, Alltherooms is another alternative with a freemium version that lets you see three months of historical data and track up to five competitors. The features include market analysis, an Airbnb calculator, historical and future data, a vacation rental score, and insights into guest demographics.

Alltherooms covers the global market. With a Pro plan, you get 49 months of historical data and 6 months of future data predictions (compared to AirDNA’s 12-month forecast).

STR Insights

STR Insights allows users to discover markets using the latest Airbnb data, focusing primarily on the U.S. market. It’s a newer company, and its main features are:

- ROI Calculator: Enter your address to predict profitability.

- Market Finder: Access to all markets in the U.S.

- Real-Time Data Analytics: Relevant Airbnb data with real-time updates.

- Neighborhood Analysis: Airbnb and VRBO rental comps.

Is there a Free Airbnb Rental Calculator?

Yes, Rabbu offers a completely free vacation rental calculator. While other companies like AirDNA and Alltherooms provide free access to basic features, you’ll need to subscribe to their paid plans to get the necessary in-depth insights. Subscription options are available on a monthly, quarterly (like Mashvisor and STR Insights), or annual basis.

Is AirDNA Worth It?

The short answer is: yes. For seasoned real estate investors, AirDNA and similar tools are well worth the money. Having accurate data in high-revenue, competitive markets is essential and can help you avoid costly mistakes. If you want to understand the market inside and out and determine what kind of properties to buy, these tools are a great starting point for your market research.

On the other hand, if you rent out just one property in your local area and already understand the market dynamics, a tool like this is likely redundant.

Wrapping Up

Use Airbnb calculators effectively to analyze and forecast earnings and profit, and to optimize pricing strategies for your vacation rental properties. You can subscribe to these tools to research investment opportunities or to understand the local market and improve your existing Airbnb business, then unsubscribe once everything is set.

Afterward, you’ll be able to run your business efficiently, especially if you automate repetitive tasks with a reliable channel manager and property management software, such as iGMS.

iGMS can put your business on autopilot by:

- Managing multiple accounts and listings on the top OTAs from a single interface

- Creating essential reports on your business results within minutes

- Adjusting your pricing in a smart way through integrations with PriceLabs, DPGO, and Wheelhouse

About the Author

Zorica Milinkovic is a B2B SaaS writer who is passionate about psychology, marketing, and, when inspiration strikes, cooking. You can find her on LinkedIn.