Airbnb Statistics: Revenue in the U.S, Daily Rates, Global Growth in 2024

If you’re curious about Airbnb’s performance in 2024 and whether investing in an Airbnb business is still profitable, here’s what you should know.

CEO Brian Chesky shared the following about the company’s financial results for the first quarter of 2024:

“We had our best Q1 ever, with 133 million nights and experiences booked, along with double-digit supply growth across all regions.”

Sure, Airbnb could be doing well, even better than ever as a company, but how does this reflect on individual hosts wanting to make a stream of passive income or a full-time living?

Here are some Airbnb statistics you may find interesting:

- Every second, 6 guests check into an Airbnb listing.

- Airbnb has a 150+ million guest user base.

- Active listings exceeded 7.7 million by the end of 2023.

- Airbnb revenue increased by 16% from $1.9 billion in Q4 2022 to $2.2 billion in Q4 2023.

- Nights and Experiences Booked grew 12% in Q4 2023 compared to a year ago.

- The average host earns $13,800 annually.

- About 70% (two-thirds) of Airbnb guests are 25 – 40.

- Only about 18% of Airbnb users are 50 and older.

- 34% of Airbnb hosts in the United States hold Superhost status.

- On average, Superhosts earn 29% more revenue per year than standard hosts.

- Most Airbnb listings in New York City, USA, as of January 2024, were for longer-term rentals.

- As many as 77% of Airbnb users said their desire to live like locals made them choose Airbnb.

- The average booking window for Airbnb reservations is 33 days.

Curious how these numbers apply to your own hosting potential? iGMS can help you turn insights into action with the right tools and support.

Comprehensive Airbnb Statistics: Where Airbnb Hosts Can Look for Reliable Data

Where do the major income opportunities lie in vacation rentals? By analyzing Airbnb statistics, you’ll notice that some locations have higher revenue potential than others. The truth is that rental earnings depend on location, property size, and market demand. Your next Airbnb could be in a beach destination, ski resort, or metropolitan area.

When looking at average figures, you need to consider both peak and slow seasons. You also have to decide what type of property works best in a given market. For example, it’s easy to see why New York is dominated by long-term rentals (monthly stays), especially given the crackdown on short-term rentals in metro areas like New York.

For comprehensive Airbnb statistics and in-depth insights, you can research Airbnb data analytics platforms such as AirDNA, Mashvisor, or Airbtics. What’s great about these data providers is how accurately you can estimate income potential and occupancy rates for very specific locations. One neighborhood could be more lucrative than another, so the only way to find out is to compare them.

Some general industry reports are available to users of industry report websites such as Statista and other third-party research websites.

Let’s take a peek at some of the important Airbnb statistics to understand market trends and key metrics you should pay attention to.

Global and Regional Airbnb Revenue

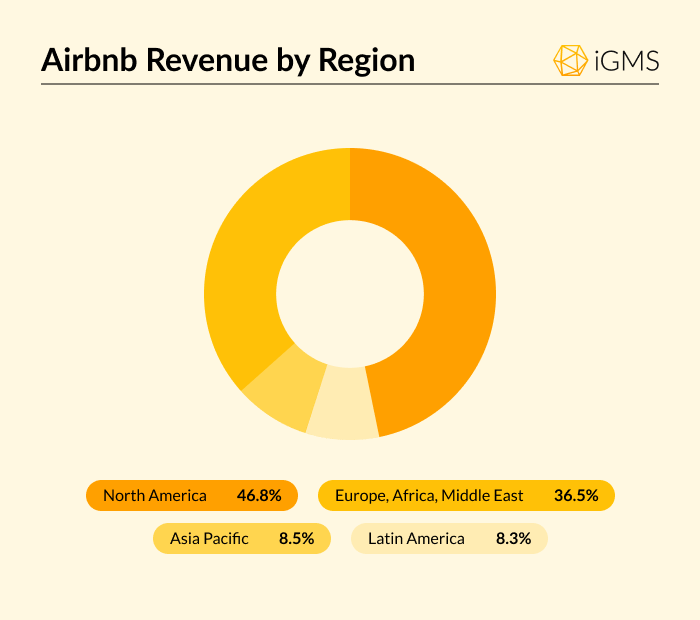

It’s no secret that the US market (North American market) is the largest short-term rental market for Airbnb, the San Francisco-based company.

However, Europe, the Middle East, Latin America, and Asia Pacific are also keeping pace. Many of these regions are growing their number of listings neck and neck. It makes Airbnb the go-to app not only for booking accommodation but also for getting inspired and deciding where to travel next.

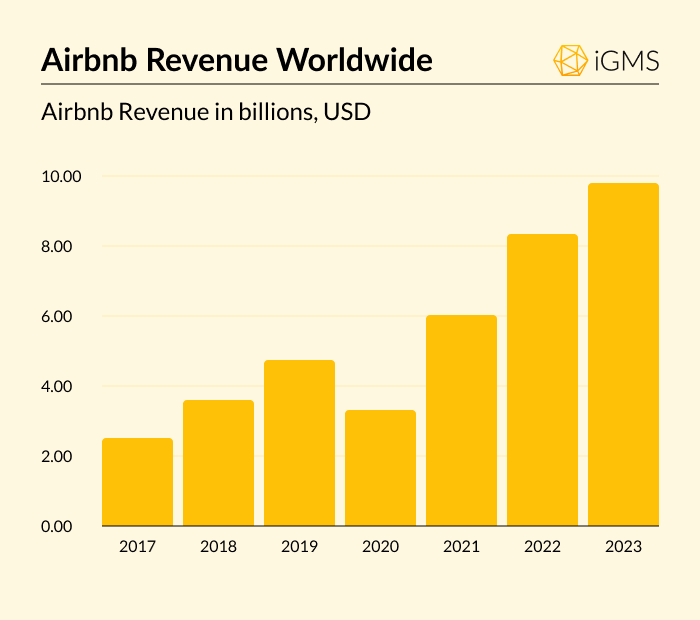

Airbnb Revenue Worldwide

Airbnb’s revenue grew from $2.56 billion in 2017 to $9.92 billion in 2023, according to Statista. That’s an impressive 3.9x increase over a five-year period globally. After a temporary halt when the COVID pandemic hit in early 2020, causing revenue to plummet, it has since rebounded exponentially, with 2023 revenue doubling pre-pandemic levels.

Airbnb Revenue by Region

Over the years, Airbnb has expanded across continents and continues to grow. Its largest markets—the U.S., Canada, the UK, Australia, and France—have seen consistent levels of nights booked. Chesky announced that Airbnb’s focus moving forward will be on less mature markets, including Mexico, Brazil, Germany, Italy, Spain, Switzerland, the Netherlands, China, South Korea, and Japan.

Region revenue analysis shows that in some countries, the number of active Airbnb listings on the Airbnb platform is smaller compared to the U.S. However, this doesn’t mean vacation rentals are unpopular. In some European countries, competitors like Booking.com hold a substantial market share. It remains to be seen if Airbnb will claim the top spot in these regions in the future. In terms of market share, Booking is a larger platform because it lists not only vacation rentals but also hotels.

U.S. Cities Ranked by Number of Airbnb Listings

The number of active Airbnb listings is a good indicator of the market size and its maturity. A lot of competitors is a good sign that the property could be profitable from day one.

According to Statista, this is the number of Airbnb listings in U.S. cities as of February 2024:

- Los Angeles 45,595

- New York City 39,719

- Austin 15,419

- San Diego 12,819

- Chicago 8,949

- Nashville 8,850

- San Francisco 8,056

- New Orleans 7,075

- Seattle 6,882

- Washington D.C. 6,853

- Dallas 5,642

- Denver 4,971

- Boston 4,204

- Oakland 2,749

- Columbus 2,668

U.S. Cities Ranked by Average Monthly Revenue

If you’re doing market research, one of the first things to analyze is average monthly revenue. However, be aware not to compare apples to oranges. Studio apartments are hard to compare to 4-bedroom properties and private rooms to luxury suites. Compare average bookings and calculate the average income of similar properties.

Also, average monthly revenue is a figure that takes into account the annual income of Airbnb listings divided by 12. It doesn’t take into account seasonal fluctuations, but it gives you an idea of how your property could be profitable in that particular market. Total nights booked are the gross amount, so keep in mind that if you’d like to calculate net income.

According to Airbitisc, these are the Top 10 Airbnb Cities in the USA that can generate more than the average $2,000 monthly income. The following cities are based on a 1-bedroom property.

- Kissimmee, Florida – $2,607 monthly revenue

- Cleveland, Ohio: $2,543 monthly revenue

- Lake Arrowhead, California: $2,514 monthly revenue

- Canyon Lake, Texas: $2,421 monthly revenue

- Las Vegas, Nevada: $2,400 monthly revenue

- Philadelphia, Pennsylvania: $2,382 monthly revenue

- Big Bear Lake, California: $2,291 monthly revenue

- South Salt Lake, Utah: $2,203 monthly revenue

- Baltimore, Maryland: $2,124 monthly revenue

- Springfield, Missouri: $2,010 monthly revenue

Masvisor on the other hand, lists the Best Cities that generate between $3,000 and $4,000 in monthly revenue:

- Smyrna, GA: $3,015

- Tigard, OR: $3,027

- Colorado Springs, CO: $3,050

- Dallas, TX: $3,074

- Oakland, CA: $3,078

- Eugene, OR: $3,096

- San Bernardino, CA: $3,109

- Traverse City, M: $3,110

- Sacramento, CA: $3,113

- Pensacola, FL: $3,125

Average Daily Rate on Airbnb in the U.S.

By looking at the metric called average daily rate, Airbnb hosts will get insight into the average price guests pay per night.

In the USA, an Airbnb host can expect to earn an average daily rate of $236.95 based on Airbtics’ data.

This is how ADR looks in 10 U.S. cities according to Statista:

- San Francisco $392

- Los Angeles $292

- San Diego $279

- Austin $224

- New Orleans $207

- Dallas $192

- Boston $168

- Seattle $165

- Chicago $161

- New York City $156

Average Occupancy Rate of Airbnb Listings

The Airbnb occupancy rate is a key metric that measures the percentage of nights a property is booked compared to the total number of nights it is available. This rate provides insight into how well a property performs in terms of attracting guests and maintaining bookings. A higher occupancy rate generally indicates strong demand and effective property management, while a lower rate may suggest the need for adjustments in pricing.

Airbtics’s list of highest occupancy rates in 2023. looks like this:

- Fort Collins: 68%Peak Season: July

- Seattle Airbnb: 76%Peak Season: July

- Memphis : 58%Peak Season: April

- Milwaukee: 60%Peak Season: July

- Ontario, NY : 56%Peak Season: July

- Phoenix Airbnb : 60%Peak Season: March

- Austin Airbnb: 61%Peak Season: April

- San Antonio: 57%Peak Season: July

- Newark, NJ : 60%Peak Season: September

- Houston Airbnb: 56%Peak Season: July

- Fresno Airbnb: 54%Peak Season: July

- Chicago : 66%Peak Season: July

- New York : 72%Peak Season: June

- Boston : 81%Peak Season: October

- Gainesville, FL: 56%Peak Season: August

Airbnb Statistics on User Demographics

Airbnb has seen a surge in both users and hosts over the years. In addition to a growing guest base, it has the fastest-growing host demographic among booking platforms. The host community has surpassed 5 million globally on the Airbnb platform. Many have seized the opportunity to invest in short term rentals. In the post-pandemic years, there has been a significant increase in the number of first-time hosts. This trend highlights how people are recognizing the potential of short-term rentals as a viable income stream.

Airbnb’s user base has always been made up of those who prefer local, authentic experiences over the cookie-cutter nature of hotel rooms. Some of the most booked listings include themed Airbnbs, glamping sites, treehouses, and other unique stays. Guests love the personalized, tailored approach. In every region, Airbnb guests seek distinctive accommodations that reflect the local culture and charm.

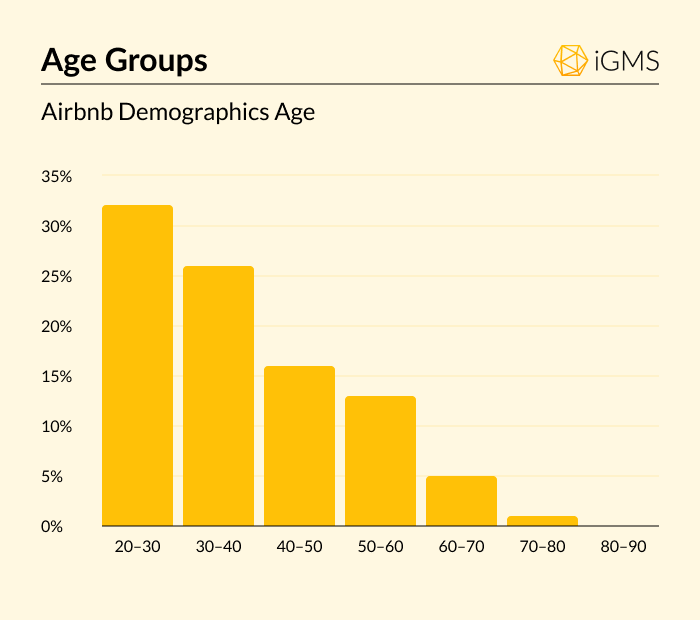

Age Groups

Two-thirds of Airbnb’s user base consists of Millennials and Gen Z, while only about 6% are over 60 years old. Historically, Airbnb’s primary demographic skewed toward younger travelers, who were also early adopters. However, this has evolved over time, and today Airbnb hosts can expect guests from all age groups, though baby boomers remain less common.

In terms of gender, around 54% of the user base identify as female, while 46% identify as male, which is almost proportionate.

Purpose of Stay

The ratio of tourists to business travelers on the Airbnb platform is actually quite balanced. The percentage of business travelers choosing Airbnb over hotels initially grew because Airbnb was more affordable. Today, some business travelers prefer the home-like comfort of an Airbnb, regardless of the cost.

However, the rise of remote work introduced bleisure—a blend of business and leisure—as digital nomads and remote workers combined work and travel. As a result, the line between business and leisure travel has never been more blurred.

Airbnb statistics according to Worldmetrics show that 47% of bookings are for groups of three or more guests. This means if you manage 2+ bedroom vacation rentals that accommodate groups, you have a good chance of being booked. Hosts can use this insight to tailor their properties by offering additional beds or larger spaces to attract group bookings.

Thoughts on Market Growth and Airbnb Trends

Airbnb continues to solidify its competitive edge, setting a high standard for other platforms within the industry. The company has shown interest in expanding and strengthening its position further into regions like Asia, Latin America, and underperforming areas of Europe. While identifying booking trends across different regions is important, analyzing Airbnb statistics in local markets is even more crucial.

The U.S. remains the largest market overall, and hosts planning to invest in vacation rental properties should focus on understanding local demand and staying informed about Airbnb restrictions in residential areas to avoid potential issues.

Other online travel agencies (OTAs) like Expedia and Vrbo shouldn’t be overlooked either. Expedia reported $104 billion in bookings and had approximately 50 million users in 2023. This platform can secure an additional income stream.

In comparison, Vrbo (which is part of Expedia Group) generated an estimated $3.3 billion in 2023, with 17.5 million unique visitors and 15 million app downloads last year, according to Business of Apps. However, this represents substantial growth for Vrbo compared to its $1.22 billion revenue in 2016. They almost tripled their income.

Each booking website mentioned shows growing trends in both revenue and user base, indicating that short-term rental properties still have a bright future ahead. If you’re already a host, you can step up your game by optimizing and automating your daily routine. Check out how iGMS can help you.

About the Author

Zorica Milinkovic is a B2B SaaS writer who is passionate about psychology, marketing, and, when inspiration strikes, cooking. You can find her on LinkedIn.