Shared Economy Tax – Tips to Maximize Your Airbnb Tax Deductions

Just like other businesses are allowed to deduct certain expenses, tax regulations also make provisions for Airbnb hosts to lower their taxation bills by claiming Airbnb tax deductions.

If you operate in the rental space, continue reading to learn more about how taxation works for vacation rental companies and which tax deductions are allowable in this industry.

Remember, though, that the information shared in this blog post cannot be considered tax advice. Always consult a tax advisor if you feel unsure about taxes or encounter any tax problems.

Should I Record my Airbnb Income and Expenses for Tax Purposes?

Before you start to record your business income and expenses for tax season, it’s important to determine if you’ll need to pay taxation on your property rental in the first place. To figure this out, there’s one key rule — the 14-day rule — that you need to understand clearly.

In short, this rule determines if a property qualifies as a personal residence or a vacation rental home. Moving forward, this will have a massive impact on how your taxes, including tax-deductible expenses, get calculated.

In the US, according to the Internal Revenue Service (IRS), if you rent out your property for less than two weeks (in other words, 14 days or fewer) during a year, it’s regarded as a personal residence and not a vacation rental property. In this event, you don’t have to report the rental income. That being said, you also won’t be able to deduct rental expenses.

If your property is regarded as a vacation rental property (in other words, it gets rented out for more than 14 days per year), you’ll need to report all your rental income. In this case, it becomes key that you record your Airbnb income and expenses diligently for taxation reasons.

As it will be difficult to determine at the beginning of the year how many nights you’ll use it for personal use, it’s better to ensure that you keep accurate records of your income and expenses from the start. Not only will you need this information when it’s tax time, but it can very likely help you save yourself a significant sum of money and preserve your rental income.

Which Airbnb Expenses Are Tax Deductible?

There are several expenses that short-term rental hosts can deduct from their taxable income if their property isn’t used as their primary residence. In a nutshell, a tax-deductible expense is considered any basic business expense that was incurred to keep your property in proper condition. In other words, expenses that went towards managing and maintaining the vacation rental property.

Examples of the most common Airbnb tax-deductible expenses are:

- Service fees are charged by a property management company, real estate agent, vacation rental software solution, and/or an online travel agency (OTA) like Airbnb, etc.

- Cleaning supplies

- Fees paid for cleaning services

- Rental and property taxes

- Property insurance

- Marketing and advertising cost

- Utilities

- Maintenance and/or repair costs

- Business-related transportation costs

- Expenses related to improving the guest experience, like leaving welcome gifts

- Legal costs

Suppose you have a dedicated home office from where you run your vacation rental business. In that case, you’ll also be able to deduct expenses, like stationery and office supplies, relating to the upkeep of such a home office. Even a seemingly insignificant tax deduction can quickly add up. So, be sure to keep accurate records from the beginning.

Will I Get Tax Forms from Airbnb?

Vacation rental platforms, such as Airbnb, will send a 1099-K form only to hosts who have received over 200 reservations and generated more than $20,000. If you didn’t receive a tax form, it doesn’t mean that you don’t owe any tax, though. If your profit was less than this amount, you might still have to pay some tax.

If you had any taxes withheld from your payouts, they’ll also send you a form so that you can claim these on your return.

Schedule C and Self-employment Tax

In addition to the 1099-K form that you might receive from the vacation rental platform, you might also need to complete a Schedule C form and pay self-employment tax.

For example, if you offer extra services, like laundry and home-cooked meals, on top of renting out your property to guests, you’ll also need to fill in a Schedule C form (Form 1040). The reason for this is that the tax authorities in the US might regard your business activity as more substantial than simply renting out a vacation rental property to earn a passive income.

In this case, you might also be responsible for paying self-employment taxes, like Social Security and Medicare contributions, on top of income taxes.

Do I Have to Collect Occupancy Tax?

Whether or not you’ll need to collect occupancy tax (also called hotel tax or transient lodging tax in some states) will depend on your jurisdiction. In many instances, hosts are required to collect occupancy tax directly from guests. If this is the situation, they’ll also have to submit the occupancy taxes that they’ve collected to the relevant tax authority.

However, if this doesn’t apply to your city, Airbnb will be responsible for collecting and sending the occupancy tax on your behalf.

Should I Get Professional Tax Advice?

Even when you’re armed with these tax tips and have a solid understanding of how income taxes work, it’s highly recommended that you seek advice from a professional. One of the reasons for this is that the tax rules and laws differ from state to state. Some states, for example, collect hotel tax (also called occupancy tax or transient lodging tax in certain jurisdictions) on short-term rentals.

Expense Tracking Apps for Your Airbnb Business

In addition to seeking professional tax advice, it’s also a good idea to invest in software solutions to help you streamline the record-keeping process. This way, you don’t have to look for and analyze old credit card statements come tax time. Here are three apps that you can check out:

Stessa

Stessa is trusted and loved by real estate investors to simplify the finances of their rental properties, including short-term rentals. You can use it for tracking, managing, and reporting on how your properties perform. Its income and expense tracking automation feature in particular is very useful. What’s more, it can also generate tax-ready financial reports. Not only will its intuitive visual dashboard simplify matters, but it will also help you to save loads of time.

Hurdlr

Unlike Stessa which caters specifically to stakeholders in the real estate and short-term rental industries, Hurdlr focuses on helping freelancers, solopreneurs, and independent workers in various industries with their finances. You can use it to track your business expenses, mileage, and tax deductions in real time. Core financial reports are also included in its list of features. What makes this app so attractive is that it can help you maximize your income by minimizing your taxes.

QuickBooks

You’re probably already familiar with QuickBooks. It’s one of the leading names in accounting software and can help you track your income and expenses. Similarly to Hurdlr, it also focuses on maximizing your tax deductions by tracking potential tax deductions on your behalf.

Another useful feature is its automatic tax calculations. To help you avoid nasty surprises, it shares automatic quarterly tax calculations to help you plan better for tax season.

Simplify Your Property Management to Be Ready for Tax Season

There’s nothing wrong if hosts want to minimize their tax liability, as long as they’re doing so without breaking any rules. However, to be able to do that, you’ll need to have meticulous records. Otherwise, filing a tax return will become a nightmare that you’ll dread every year. And we all know how complicated a tax return can get!

If you’re renting out your property for only a few nights, it might still be easy to stay on top of your record-keeping without the help of a third-party tool. However, as soon as your Airbnb business takes off and you’re renting out your property more regularly, it will become much more time-consuming.

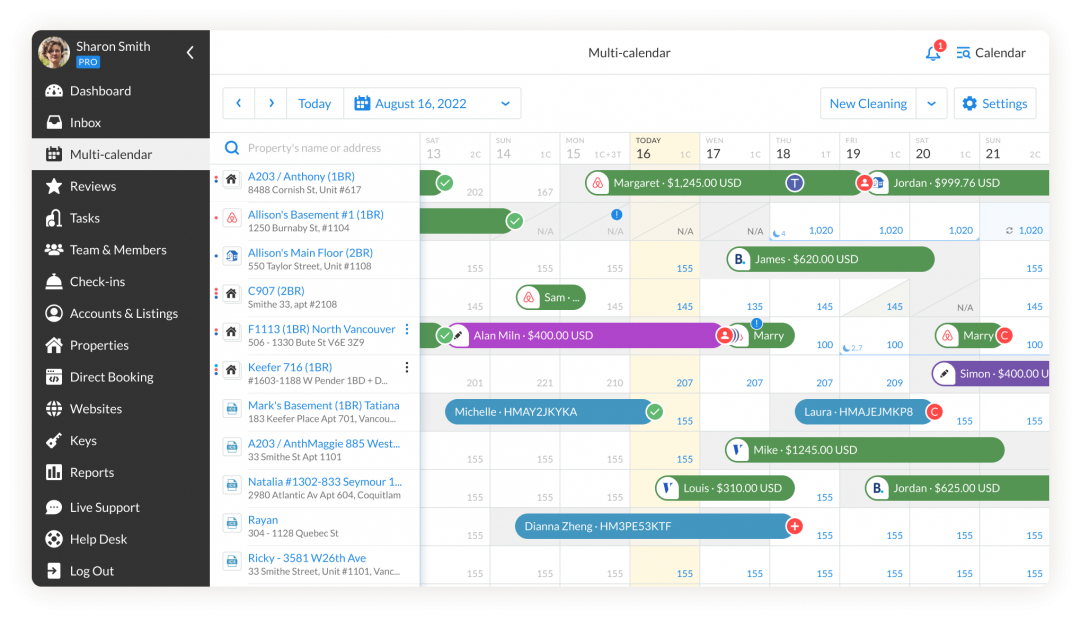

In addition to investing in an Airbnb expense tracking app, it’s also a great idea to add a vacation rental software solution to your tech stack. Vacation rental software, like iGMS, can help you save loads of time on key routine tasks like guest communication and cleaning management, ultimately freeing up time that you can devote to other critical business operations, like seeing your taxes get paid on time and managing your expenses. Plus, you can deduct the cost of the subscription from tax!

In addition to guest communication and cleaning management, iGMS can also help you with tasks such as:

- Managing multiple accounts and listings on the top OTAs from a single interface

- Synchronizing reservations across multiple platforms to eliminate the risk of double bookings

- Organizing messages into a single feed with a unified inbox

- Improving communication with automated templates and triggered messaging

- Creating and coordinating cleaning tasks with live tracking to completion

- Creating your own direct booking website

- Managing direct bookings using a direct booking management toolkit

- Processing payments securely via integration with Stripe.

- Creating essential reports on your business results within minutes

- Adjusting your pricing in a smart way through integrations with PriceLabs, DPGO, and Wheelhouse

- Automating the process of guest reviews