Expert Insights on the Best Places to Airbnb in California for 2024

California is a prime location for adventure because Airbnb has revolutionized the way we invest and travel. The state is a popular vacation spot because of its diversity, which ranges from the tall forests of Yosemite National Park to the beaches of San Diego.

Knowing the top Airbnb locations in California can improve your experience, whether you’re looking to entertain guests in a chic San Francisco loft or unwind in a Joshua Tree cabin with a private hot tub.

The goal of this article is to highlight the best vacation rentals throughout the Golden State, ranging from vibrant properties in downtown Los Angeles to quaint spots in South Lake Tahoe.

We’ll lead you through both tranquil getaways and busy city life with insights powered by our new Market Insights tool—each providing distinctive features like heated pools, outdoor decks, and more.

Let’s help you find the ideal location for your upcoming California adventure, whether it’s for a short vacation or passive income.

The California Airbnb Market

California’s Airbnb market is as diverse as its landscapes, from San Diego’s beachfront bungalows to cozy cabins in the Sierra Nevada Mountains. Despite its popularity among tourists, the local regulations heavily influence Airbnb operations. For example, while San Francisco and Los Angeles have specific rules that welcome short-term rentals, Santa Monica and other cities impose stricter limits.

The types of properties available significantly affect host earnings. Scenic areas like Lake Tahoe or the Santa Monica Mountains often see larger properties with hot tubs and outdoor decks earning more, thanks to their appeal to tourists seeking luxury. In urban areas like downtown Los Angeles or near San Francisco’s Golden Gate Park, even compact condos can rake in considerable sums due to high demand from tourists and business travelers.

Host earnings vary widely; places like Napa Valley and Palm Springs often see higher revenues due to their prime location and the allure of unique features like vineyard views or mid-century modern decor. Conversely, quieter, more secluded spots might not earn as much but attract those looking for a peaceful getaway.

If you’re thinking about joining the ranks of Airbnb hosts in California, it’s essential to check if you need a license. There are no state-level requirements, but many cities ask hosts to register and obtain a business license.

For detailed info on what’s needed in your area, look into your city’s licensing requirements for Airbnb operators.

Top Markets for Airbnb in California

We’re going to take a look at some of the top markets in the state by dipping into AirDNA data on how rentals are performing in those areas. We’ll break it down into draws, i.e. what brings the travelers to town.

Coastal Cities

San Diego

Famed for its stunning beaches, vibrant cultural scene, and year-round sunny weather, San Diego is a premier tourist destination in Southern California for a reason.

Attractions like the San Diego Zoo, Balboa Park, and proximity to the Pacific Ocean draw millions each year, making it a hotbed for tourists. It’s not just a great place to visit; it’s also a booming market for short-term rentals. Let’s look at the AirDNA data.

With a market score of 64, San Diego offers a promising mix for Airbnb investors. The city’s high rental demand score of 73 shows there’s a steady flow of tourists and business travelers needing places to stay. This constant demand is a big plus for those looking into the short-term rental market.

Despite its perks, San Diego does have its challenges, notably in the regulatory arena with a score of 46. This means local laws might need extra attention from Airbnb hosts. However, the moderate revenue growth and seasonality scores suggest a stable market that can provide income throughout the year, not just during peak seasons.

Overall, the blend of high tourist appeal and solid rental demand makes San Diego an attractive spot for Airbnb investments. While navigating regulations requires some effort, the city’s popularity and consistent market conditions offer valuable opportunities for those looking to dive into short-term rentals.

Santa Monica

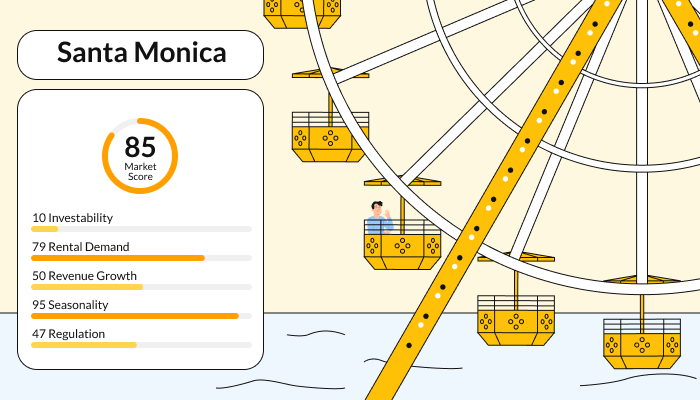

Santa Monica, known for its iconic pier, upscale shopping, and beautiful sandy beaches, is a standout tourist destination in Southern California. Its attractions, including the Third Street Promenade and the close proximity to the rest of Los Angeles, draw countless visitors each year, making it an appealing spot for both tourists and short-term rental investors. So what does the Airbnb market there look like?

It boasts a high market score of 85, signaling a strong market for Airbnb investments. The rental demand score of 79 reflects a high level of consistent interest from visitors, driven by the city’s abundant attractions and its reputation as a prime coastal city. This ensures a steady stream of potential guests for Airbnb hosts.

However, the investability score of 10 indicates significant challenges, primarily due to strict local regulations which have a score of 47. This suggests that while the demand is high, the regulatory environment in Santa Monica requires careful navigation and compliance from hosts. The high seasonality score of 95 points to a market that thrives particularly during peak tourist seasons, offering potential for high returns during these periods.

The revenue growth score of 50 suggests a balanced potential for earnings growth, reflecting both opportunities and the competitive nature of the market.

While Santa Monica presents some regulatory hurdles, its high tourist appeal and excellent seasonality offer lucrative opportunities for those who can successfully manage the local Airbnb regulations. The city’s vibrant atmosphere and continuous influx of tourists make it a valuable market for short-term rental investments, especially during peak seasons.

Urban Hubs

San Francisco

With its iconic Golden Gate Bridge, historic cable cars, and vibrant cultural scene, San Francisco is more than just a pretty postcard. It’s a real urban hub that attracts millions of visitors each year, eager to experience its diverse neighborhoods, world-class cuisine, and bustling tech scene. This makes San Francisco a prime candidate for Airbnb investments. Here’s a detailed look at the AirDNA data:

San Francisco’s market score of 70 indicates a good overall performance in the short-term rental market. The rental demand score of 66 showcases a solid interest in the city, driven by its continuous influx of tourists and business travelers, thanks to its status as a tech and cultural center.

However, the investability score of 10 reflects significant challenges, primarily due to a complex regulatory environment, as indicated by a regulation score of 36. San Francisco’s strict rules on short-term rentals require hosts to navigate a series of permits and compliances, which can be a major hurdle.

The high seasonality score of 97 suggests that San Francisco’s short-term rental market thrives during certain peak times of the year, likely aligning with major festivals, conferences, and tourist seasons. This presents a potential for high earnings during these periods, despite the overall challenges.

Revenue growth at a moderate score of 50 points to steady potential for earnings, indicating that while growth is not explosive, it is consistent.

With its high tourist appeal and significant seasonality, San Fran offers attractive opportunities for those able to manage the stringent regulations. It’s a compelling city for Airbnb investments, especially for hosts who can capitalize on the peak tourist and event seasons.

Los Angeles

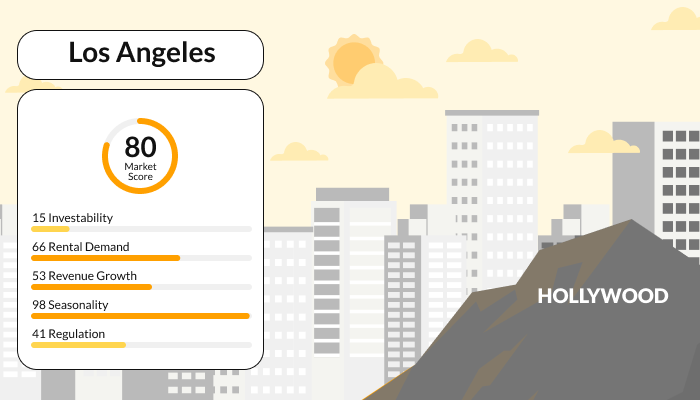

Los Angeles, a city known for its beaches, carefree summer vibe, and Hollywood glitz, is not only a popular destination for tourists but also a booming Airbnb investment market. Its allure draws a wide range of tourists all year long, from the star-studded Walk of Fame to the tranquil hiking trails of the Santa Monica Mountains. What does the data say?

A market score of 80 is pretty up there, demonstrating a strong performance in the short-term rental sector. A rental demand score of 66 indicates strong, steady demand for accommodations, driven by the city’s status as a major entertainment, business, and tourist destination.

The investability score of 15, however, highlights challenges, primarily due to a regulatory score of 41. This suggests that while the market is active, navigating local Airbnb laws requires careful attention and adherence to ensure compliance and profitability.

A seasonality score of 98 underscores that Los Angeles’s short-term rental market excels during certain peak periods. This high score likely reflects the influx of tourists during major events, film festivals, and the popular summer season, providing ample opportunity for high rental earnings during these times.

Revenue growth at 53 suggests a steady increase in earnings potential, indicating a market that, while competitive, offers consistent opportunities for growth.

All things considered, Los Angeles’s alluring combination of strong seasonal demand and high tourist appeal offers investors in Airbnb profitable prospects. The city’s dynamic lifestyle and steady stream of tourists make it a desirable market for those wishing to get into short-term rentals, even with the regulatory obstacles. This is especially true if they can optimize profits during high seasons.

Hidden Gems

Palm Springs

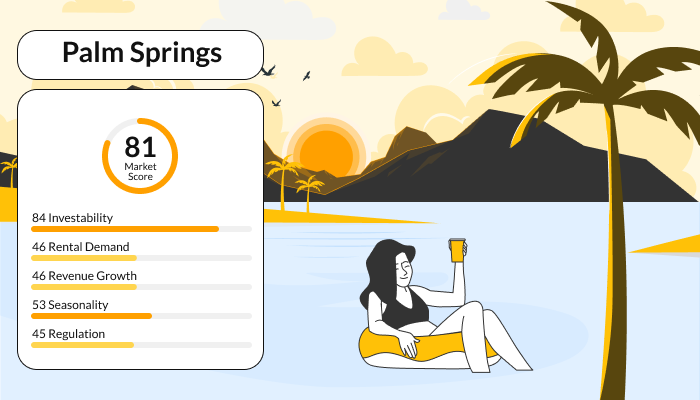

Renowned for its mid-century modern architecture, stunning desert landscapes, and an array of outdoor activities like golf and hiking, Palm Springs is not just a haven for relaxation but also a thriving market for Airbnb investments. Its unique blend of leisure and artistic allure draws tourists year-round, particularly those seeking a stylish getaway in the heart of the desert.

Here’s a detailed breakdown of the AirDNA data for Palm Springs:

With a high market score of 81, Palm Springs stands out as a strong performer in the short-term rental market. The impressively high investability score of 84 reflects the city’s attractiveness as an investment destination, likely driven by its popularity as a retreat for both leisure and inspiration.

The rental demand and revenue growth both score 46, indicating a moderate level of consistent demand and steady earnings growth. This suggests that while Palm Springs may not have the explosive demand of larger cities, its market is stable, with a loyal visitor base that appreciates its unique offerings.

A seasonality score of 53 indicates that Palm Springs experiences relatively stable demand throughout the year. Unlike markets that fluctuate dramatically with the seasons, Palm Springs maintains its appeal across different months, attributed to its perennial sunny weather and year-round events that attract visitors.

The regulatory score of 45 points to a moderately challenging regulatory environment. Potential investors and hosts in Palm Springs should be aware of local laws and compliance requirements, which, while manageable, are crucial for operating successfully in this market.

Palm Springs presents an attractive investment opportunity for Airbnb due to its consistent market conditions and distinct tourist appeal. For those hoping to profit from short-term rentals, the city appeals due to its unique combination of artistic charm and desert beauty, as well as its stable investment environment.

Joshua Tree

Joshua Tree, celebrated for its stark desert landscapes, iconic twisted trees, and a sky that turns into a blanket of stars at night, is a favorite among nature lovers and adventure seekers. This desert haven, also known for its proximity to the Joshua Tree National Park, draws visitors looking for unique outdoor experiences and a peaceful retreat from bustling city life.

Here’s a closer look at the AirDNA data for Joshua Tree:

Joshua Tree stands out with an impressive market score of 93, highlighting its excellent performance in the short-term rental market. The high investability score of 95 is particularly noteworthy, signaling strong investor confidence and the market’s robust potential for Airbnb investments.

Despite the high market scores, the rental demand is moderate at 46. This suggests that while the demand isn’t overwhelming, those who do visit prefer unique lodging experiences, often seeking out properties that offer a taste of desert life and easy access to natural attractions.

The revenue growth at 50 indicates steady, though not rapid, potential for earnings. This steady growth reflects a market that is consistently reliable but not prone to sudden spikes in rental income, which can be ideal for investors looking for stable returns.

A seasonality score of 49 shows that Joshua Tree experiences moderate fluctuations throughout the year, likely peaking during cooler months when the desert climate becomes more inviting.

The regulatory score of 63 points to a relatively moderate regulatory environment, suggesting that while there are some rules and regulations to navigate, they are not as restrictive as in some other regions.

For those wishing to take advantage of Joshua Tree’s distinctive recreational and environmental offerings, in particular, it makes a good case. As far as starting Airbnbs in California goes, Joshua Tree is a good bet. It’s a promising location because of its stable market conditions, high investor confidence, and reasonable licensing requirements.

How does California compare to other states?

California is a top location for Airbnb and vacation rental investments in the United States based on the research we’ve done so far, despite the fact that it presents certain difficulties of its own.

Let’s take a look at California’s investment climate in comparison to other hot markets.

California vs. Florida

- Tourism Appeal: Both states have a wide range of attractions that make them very appealing to tourists. While Florida is well-known for its sunny beaches, theme parks like Disney World, and exciting nightlife, California offers a distinctive combination of beaches, mountains, and urban settings from San Diego to San Francisco.

- Regulatory Environment: The regulatory landscape in California is more intricate and stringent, and it varies greatly between cities. It may be simpler for new investors to enter the market in Florida because the state’s regulations governing short-term rentals are typically more uniform and forgiving.

- Seasonality: Florida enjoys a nearly year-round tourism season, with winter months being especially popular as travelers fleeing colder climates. Although there is a lot of year-round tourism in California, some places, like San Francisco, may experience variations because of the colder climate.

California vs. Texas

- Urban Markets: Texas’s Austin and Dallas are becoming major tech hubs, akin to Silicon Valley in California. Nonetheless, Texas often boasts a more advantageous tax and regulatory landscape, which may entice investors in Airbnb.

- Rental Demand: Texas has witnessed an increase in demand for rentals, especially during big events like Austin’s SXSW festival and in urban areas. California continuously has a high demand for rentals, both in tourist destinations like Los Angeles and in tourist/natural areas like Lake Tahoe.

- Investability: Texas has a lot of room to grow, but California’s developed markets, albeit frequently with higher entry costs, offer solid data and proven success models.

Investment Outlook

California presents special opportunities that are difficult to replicate in other states, despite its regulatory and financial obstacles. Its varied topography accommodates a broad spectrum of visitor interests, from wine tasting in Napa Valley to skiing in the Sierra Nevada. The state’s robust economy and internationally renowned cities draw a sizable number of business visitors, which raises the demand for short-term rentals.

To sum up, even though states like Florida and Texas present attractive prospects for Airbnb investors, California continues to be a top pick because of its unmatched combination of business travel, tourism, and a wide range of offerings.

Nonetheless, to succeed in California’s rental market, one must pay close attention to regional laws, prioritize quality, and manage and maximize rental properties using technology efficiently.

Technology for Better Market Insights

In order to successfully navigate the intricacies of the vacation rental market, technology is essential for both property managers and Airbnb hosts.

By using cutting-edge technological tools, they can effectively optimize pricing strategies and obtain profound insights into market dynamics. Technology makes these things possible in the following ways:

Understanding Market Dynamics

- Real-Time Data Analysis: Technology enables the aggregation and analysis of vast amounts of data from various sources, including booking platforms, social media, and economic indicators. This real-time data provides hosts with up-to-date information on market trends, tourist patterns, and competitive landscapes. By understanding these dynamics, hosts can make more informed decisions about when to adjust their offerings based on demand.

- Competitor Monitoring: Advanced tools can track the performance and strategies of competitors in the same region or market segment. This includes analysis of pricing models, occupancy rates, promotional tactics, and guest reviews. With this information, hosts can identify what works well and what doesn’t, allowing them to adapt and refine their strategies to stay competitive.

- Sentiment Analysis: Technology can analyze reviews and feedback across platforms to gauge guest satisfaction and expectations. This helps hosts understand the strengths and weaknesses of their own properties and those of their competitors, providing insights into areas that may require improvement or can be highlighted as key selling points.

Optimizing Pricing

- Dynamic Pricing Algorithms: Utilizing AI and machine learning, dynamic pricing tools analyze multiple factors such as seasonal demand, local events, historical data, and booking patterns to automatically adjust rental prices in real-time. This ensures that pricing is always optimized for maximum occupancy and revenue, without leaving money on the table or pricing out potential guests.

- Demand Forecasting: Advanced forecasting models can predict future demand for certain locations or types of properties. This allows hosts to adjust their pricing ahead of peak times or to plan promotions during expected lulls, ensuring a steady flow of bookings throughout the year.

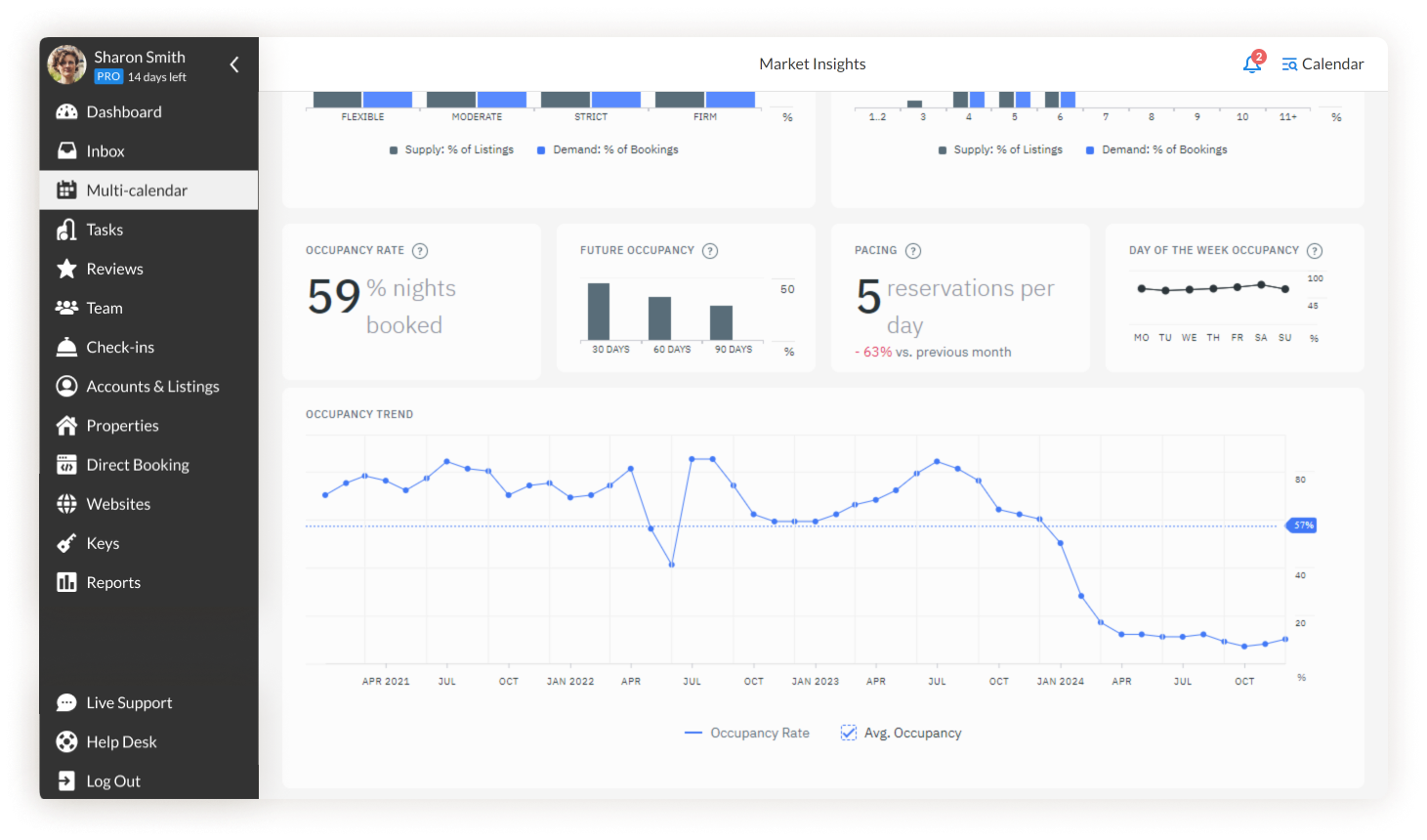

- Performance Metrics and Dashboarding: Technology provides hosts with dashboards and reporting tools that offer a comprehensive view of their property’s performance. Key metrics such as revenue per available room (RevPAR), average daily rate (ADR), and occupancy rates are tracked and compared against market averages. This not only helps in pricing optimization but also in overall strategic planning and performance evaluation.

Technology equips property managers and hosts with the necessary tools to understand market dynamics thoroughly and to implement pricing strategies that adapt to changing conditions.

This leads to optimized earnings, improved competitive standing, and a better alignment of offerings with guest expectations. These solutions are invaluable in a rapidly evolving market like short-term rentals, where understanding and agility can significantly impact success.

To give Airbnb hosts and vacation rental investors the real-time data and analytics they need to thrive, iGMS has introduced a Market Insights tool to its suite of features.

This tool will help you optimize your listings and maximize your returns by providing a thorough analysis of market trends, competition, and personalized recommendations.