Expedia Affirm: How Vacation Rentals Can Compete

Vacation rentals’ success can be linked to the flexibility and value they offer travelers. Compared to a hotel room, guests typically get more space and privacy.

While hotels might not be their direct competitor, short-term rental hosts can learn a lot from them. For instance, how they approach payments. Vacation rental owners need to pay extra special attention to their pricing and payment options to ensure that guests continue to enjoy the value and flexibility that make this type of accommodation highly appealing.

Here’s how they can remain flexible without having to offer monthly payments.

What’s Expedia Affirm?

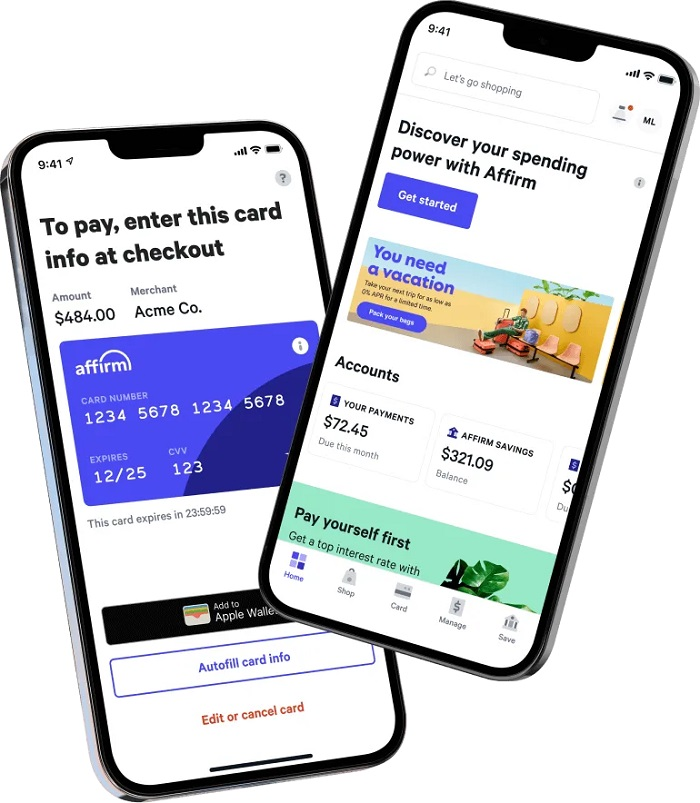

Expedia Affirm is a buy now pay later (BNPL) payment solution offered by the vacation rental platform. It lets travelers pay the total cost of the booking over time. The total is divided into simple and easy payments that you can pay over three, six, or twelve months. They’re essentially broken up into really easy payment plans based on your preference of period.

Not only does it offer flexibility, but also transparency. There are no hidden fees.

The interest rate is also straightforward. Where the majority of credit cards charge compound interest, Affirm charges a simple interest. Plus, if you were to pay late, no extra late fees get added.

How Does Expedia Affirm Work?

To use Affirm on Expedia, when a traveler is ready to proceed to checkout, all they need to do is pick “Monthly payments” and “Continue to Affirm”. Next, they’ll be asked to add a few details and select the vacation payment plan that works best for them.

After the booking has been reserved, all that’s left to do is to create an account via Affirm’s website or app and set up a monthly payment. Then you’re good to go.

The catch, though, is that it’s only available for all-inclusive vacation packages. This means that travelers who want to book a vacation rental property will have to use traditional payment methods.

What Are the Benefits?

Affordability

The most obvious advantage of using Affirm is that it makes travel more affordable. While travelers will still need to pay the full amount (plus interest), it enables them to take advantage of travel deals even when they don’t have enough money to pay the total cost.

Ease of use

When selecting Affirm as payment option, your financing application will be approved (or declined) immediately. This real-time decision also won’t have any impact on your credit score. It does perform a soft credit check to see if you qualify, but this precheck requires only a couple of details.

The ease of use also extends to paying your monthly payments. You can set up automatic payments to avoid late payments. That said, Affirm doesn’t add late payment fees.

Transparency

Aside from zero late payment fees, Affirm also doesn’t add any just because fees or other hidden fees. The interest is also easier to work out as it doesn’t use compound interest like most credit cards.

During checkout, you’ll see exactly what you’ll pay upfront. It will even display the final cost for the different payment plans so that you can make a more informed decision.

How Can Hosts Make Their Pricing More Attractive?

As mentioned earlier, this service only applies to trips that are part of an all-inclusive package. This means that travelers looking to book a vacation rental won’t qualify for this flexible payment plan.

Pricing has a huge impact on travel plans and so it’s key that hosts also explore ways that they can help guests make their next vacation a reality. One way that they can do that is to use dynamic pricing.

Put simply, dynamic pricing is a strategy where hosts adjust their pricing frequently in response to factors like season and events. This way, hosts can offer guests a better deal for trips that fall within the middle of the week or slow season, for example. Without applying dynamic pricing, hosts risk overpricing their rental when the demand decreases.

Aside from the time of the year during which the booking will occur, hosts can also use the time when the booking was made as a pricing guideline. They can, for example, decide to make last-minute bookings cheaper. This way, hosts get a good deal, while you increase the chance of securing a booking.

Implementing dynamic pricing manually, though, isn’t feasible. You’ll need to invest in dynamic pricing software to help you identify opportunities when you can offer your guests a better deal, helping them to save money. Then, ensure that your dynamic software integrates with your other software so that pricing is updated in real-time.

iGMS, for example, integrates with a number of leading dynamic pricing solutions. Then, to help you keep further track of payments, it includes features like payout reports and filters which will give you a summary of how much you’ve earned in total. Aside from tracking payments made, it’s also handy for keeping tabs on cleaning fees and future transactions.