Best Cities for Airbnb in the US in 2024

Welcome to your go-to guide on where to start your Airbnb, where choosing the right spot isn’t just luck—it’s the key to your success. As both newbies and experienced hosts know, offering travelers a memorable stay, from cozy one-bedroom retreats for romantic getaways to sprawling four-bedroom homes near lush national parks with all the amenities, opens up a world of possibilities.

But, how do you navigate through countless options to find the best Airbnb locations that not only bring in solid revenue but also provide Airbnb guests with unforgettable experiences?

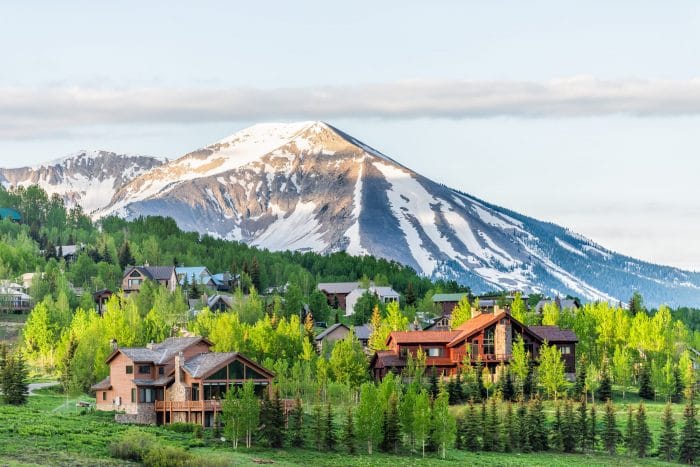

A beach house that boasts beautiful sunsets and quick access to the Atlantic, or a quirky tiny house just a short walk from the heart of a local trendy neighborhood…

The ideal spot does more than offer a roof over your guests’ heads; it weaves a story, blends design with comfort, and ticks all the boxes on the amenity list—from starlit hot tubs to kitchens ready for a family feast. And let’s not overlook the importance of those modern touches travelers seek today, like seamless Wi-Fi and spacious areas to relax after a day’s adventures.

This guide will take you from an idyllic coastal town with some stunning views, to the kind of US cities rich in history and charm tourists flock to.

The Importance of Location in the Airbnb Business

The mantra “location, location, location” couldn’t ring truer. The spots where you choose to set up your vacation rentals can make or break your success. It’s not just about having a property; it’s about where that investment property sits on a map. Let’s break down why the right location is crucial for higher occupancy rates and revenue growth.

First up, let’s talk about vacation rental demand. Imagine owning a quaint beach house with breathtaking sunsets over the Atlantic Ocean or a cozy cabin a short walk from hiking trails and national parks. These aren’t just properties; they’re gateways to experiences, and experiences are what guests are looking for.

Then there are the occupancy rates—essentially, how often your place is booked. A property in the heart of the action, like a city center apartment a stone’s throw from the French Quarter or a modern amenity-packed home in Palm Springs, doesn’t just sit pretty; it stays booked. Proximity to local hotspots, gorgeous views, and must-visit destinations means your calendar stays full, and a full calendar translates to steady revenue and additional rental income.

Speaking of revenue, let’s not skirt around the fact that your Airbnb’s location directly impacts your bottom line. Properties in sought-after locations can command higher prices, especially if they boast unique features like antique furniture, hot tubs, or a fire pit. You’re not just offering a stay; you’re providing an experience that’s worth paying for.

But it’s not all about being in the thick of it. Sometimes, the allure lies in the escape—properties that offer a break from the bustle, nestled in areas where natural beauty or quiet charm is the main attraction.

In essence, your Airbnb’s location is the cornerstone of your hosting success. It influences everything from how often your door swings open to guests to how much you can charge to stay. It’s about striking the right balance between accessibility to attractions and the unique appeal of your property.

Top Criteria for Selecting the Best Cities for Airbnb Investment

When hunting for the best Airbnb locations, there are a few key criteria that can set your property apart from the rest. These factors not only attract guests but also ensure they have a memorable stay. Here’s what to look for:

1. Accessibility to Tourist Attractions and the City Center

Guests often seek the convenience of being close to the main attractions. A property within walking distance or a short drive from popular sites, vibrant city centers, or even unique local neighborhoods can significantly increase its appeal.

Locations near the heart of the action—think properties a stone’s throw from San Diego’s beaches or the bustling streets of New Orleans’ French Quarter—tend to see higher booking rates. Accessibility is key, making it easier for guests to explore and immerse themselves in their surroundings.

2. Presence of Modern Amenities in Vacation Rental Properties

Amenities like Wi-Fi are non-negotiable for guests. But features like hot tubs, fully stocked kitchens, and comfortable living spaces with natural light and gorgeous views can elevate a guest’s experience from good to unforgettable. Guests look for these kinds of modern comforts when scrolling through listings.

3. The Charm of the Property

A property’s unique character can be a massive draw for guests. Think of the rustic appeal of wooden beams, the elegance of antique furniture, or the modernity of clean lines and design inspo. These features can make your listing stand out. A space with personality tells a story. It’s about creating an environment where guests feel they’re experiencing something truly unique.

4. Proximity to Natural Attractions

For many travelers, the call of the wild is irresistible. Airbnb properties close to natural attractions like beaches, national parks, and hiking trails offer the chance to connect with nature and participate in outdoor activities. Whether it’s a beach house with stunning sunsets over the Atlantic Ocean or a cozy cabin near the Smoky Mountains, proximity to nature can be a significant selling point.

5. Overview of Property Types

The type of property you offer is also something to consider. From tiny houses perfect for a romantic getaway to larger homes designed for family vacations or holiday rentals. Understanding the diverse needs of your potential guests can lend a hand in selecting or preparing a property that caters to a wide range of people.

Nailing the right location for your Airbnb will need a mix of strategic thinking and an understanding of what today’s travelers are looking for. It’s about more than just a place to stay—it’s about opening up a gateway to exploration, relaxation, and memorable moments.

The 15 Best Airbnb Locations in the US

According to AirDNA, these are some of the most profitable cities and the US’s best Airbnb markets, each with its own story to tell and experiences to offer, from the vibrant energy of city life to the serene embrace of nature. Here are the 15 best Airbnb locations to invest in this year:

15. North Myrtle Beach, South Carolina

Tucked away at the northern end of the Grand Strand, North Myrtle Beach offers a slice of paradise with its nine miles of pristine beaches. It’s a quieter, family-friendly alternative to its southern neighbor, perfect for those looking to unwind or dive into a variety of water sports.

Golf enthusiasts will find themselves in heaven here, with numerous stunning courses that challenge and delight players of all abilities. But North Myrtle Beach isn’t just about hitting the links; it’s packed with attractions that keep the whole family entertained.

For those eyeing a smart investment, North Myrtle Beach’s appeal as a vacation destination can’t be overstated. With a variety of accommodations catering to every budget and solid 60.7% occupancy rates, not to mention an average daily rate of $498, the city presents a golden opportunity for investors looking to enter the short-term rental market.

14. Beaufort, South Carolina

In Beaufort, South Carolina, the same streets and homes that charmed audiences in movies like “The Big Chill” and “Forrest Gump” await film enthusiasts and tourists. This historic city, nestled on the coast, invites visitors to wander through its picturesque downtown, where time seems to stand still among the antebellum buildings and along the serene Beaufort River.

The city’s dining scene is a vibrant reflection of its coastal charm and cultural mosaic, serving up everything from laid-back seafood spots to upscale eateries that highlight local flavors and traditions. Freshly caught seafood and classic Southern dishes embody the spirit of Beaufort. It’s a feast for the senses, where the food tells the story of the region’s rich heritage and the Gullah culture’s profound influence.

This city has major investment potential with a typical home value of $346,580 and 61% occupancy rates. Beaufort captures the essence of Southern hospitality and charm, making it an unforgettable destination for anyone lucky enough to visit.

13. Anaheim, California

If the first thing that comes to mind when you hear Anaheim, California, is Disney, you’re not alone. The magic of Disneyland Resort captivates visitors of all ages with its blend of timeless attractions at Disneyland Park and the adventurous spirit of Disney California Adventure Park, all complemented by the lively Downtown Disney for shopping and dining delights.

But there’s more to Anaheim than just theme parks; the city invites nature lovers to explore serene spaces like Yorba Regional Park, offering walking trails, picnic spots, and fishing lakes, perfect for those seeking a peaceful escape or outdoor fun.

The city’s vibrant dining and shopping scenes, from the upscale Anaheim GardenWalk to the eclectic Anaheim Packing District, cater to every taste, while its prime location offers easy access to the wider attractions of Southern California, making Anaheim a diverse and inviting destination.

At $867,720, Anaheim’s typical home value is one of the highest on the list, but the occupancy rate of 76.5% helps balance things out by guaranteeing you bookings from tourists

12. Fernandina Beach, Florida

In the heart of Amelia Island lies Fernandina Beach, a serene escape where the beaches stretch for 13 miles, offering a quiet haven for those looking to soak up the sun, catch a wave, or reel in the day’s catch.

The adventure continues inland at Fort Clinch State Park, where history meets nature; visitors can wander through a Civil War-era fort, trek along lush trails, or set up camp by the water. For cycling enthusiasts and walkers, the scenic Amelia Island Trail weaves through the island’s breathtaking landscapes, inviting a slower pace to take in the natural beauty.

Fernandina Beach isn’t just about its picturesque outdoors; it’s a hotspot for ecotourism, where kayakers glide through marshes and paddleboarders share the water with dolphins and sea turtles.

The island’s commitment to nature is paralleled by its passion for sports, offering top-notch golf courses and tennis courts that attract players from all corners of the globe. Here, professional tournaments play out against the island’s stunning vistas, making every game a memorable experience.

This charming town is steeped in history and community spirit, evident in its historic downtown and the annual Isle of Eight Flags Shrimp Festival, which celebrates Fernandina Beach’s rich past. The local dining scene delights with fresh catches and Southern cuisine, reflecting the town’s deep connection to its surroundings.

An occupancy rate of 61.5% means that you’ll have a stable flow of guests, but it’s worth noting that an R-3 zoning district is the only one where listings can obtain a Resort Rental Dwelling Permit (RRDP). R-1 and/or R-2 zones are only available for use by STRs that have been grandfathered in, or that operated prior to the regulations.

11. Mineral, Virginia

A small town located in Louisa County, Mineral, Virginia, is known for its charming rural character, historical significance, and natural beauty. While it may not be as widely recognized as larger cities, Mineral offers a peaceful lifestyle and a variety of attractions that draw people to it.

One of the largest freshwater inland lakes in Virginia, Lake Anna is a central feature of the area. It offers a wide range of recreational activities, including boating, fishing, swimming, and water sports. The lake is also surrounded by Lake Anna State Park, which provides hiking trails, picnic areas, and beautiful scenery, making it a popular destination for both locals and visitors.

The region around Mineral is also part of Virginia’s burgeoning wine country, with several vineyards and wineries nearby. Wine enthusiasts can enjoy tastings and tours, experiencing the variety of wines produced in this scenic part of Virginia.

When compared to other places on our list, Mineral has above-average house values (around $699k), but this is somewhat mitigated by the variety of tourist activities that raise occupancy rates to 57.6%. Mineral presents a good option for individuals looking for a well-balanced combination of prospective value and affordability, as seen by its $301 RevPAR and appealing local attractions.

10. Fairbanks, Alaska

As the largest city in the Interior region of Alaska, Fairbanks offers a blend of outdoor adventure, scientific research, and cultural experiences that make it an intriguing place to visit.

It’s one of the best places in the world to witness the Northern Lights or Aurora Borealis because the city’s geographical location beneath the “Aurora Oval” offers spectacular displays of these natural light phenomena, particularly from September to April.

Then during the summer months, Fairbanks experiences nearly 24 hours of daylight, a phenomenon known as the Midnight Sun. This allows for extended days of exploration and participation in outdoor activities such as hiking, dog mushing, snowmobiling, or cross-country skiing.

The average house value in Fairbanks grew to $238,670 after being featured on AirDNA’s list last year. However, the steady occupancy rate of 64.8% continues to make this a profitable market for investors who are ready for the boom of a strong summer combined with a much quieter winter.

9. Akron, Ohio

Known as the “Rubber Capital of the World” for its historic ties to the rubber industry, Akron, Ohio, is a city with a rich history and a vibrant cultural scene. With a title like that, you might not necessarily think it would make for a great Airbnb or investment property, but think again.

Because it played a pivotal role in the rubber and tire industry, Akron is home to major companies like Goodyear and Firestone. This legacy is celebrated at sites like the Goodyear World of Rubber Museum. The Stan Hywet Hall & Gardens is a beautiful estate that is one of the largest homes in the United States open to the public.

The typical home value of $145,000 in Akron is relatively low compared to national averages, suggesting an accessible entry point for investors looking to purchase property for both short term rental property for-term rentals. This affordability could provide a lower barrier to entry for new investors or those looking to expand their portfolio.

The combination of affordable property prices, many investment opportunities, solid revenue growth, and high investability scores make it an attractive option for both new and experienced real estate investors here.

8. Port Angeles, Washington

Port Angeles, Washington, is a picturesque city nestled on the northern edge of the Olympic Peninsula, offering breathtaking views of the Olympic Mountains to the south and the Strait of Juan de Fuca to the north. This unique location, combined with a rich cultural heritage and a wide array of recreational activities, makes Port Angeles a remarkable place to visit or live.

The city serves as the perfect gateway to Olympic National Park, a vast expanse of wilderness that encompasses nearly a million acres of diverse ecosystems, from rugged coastlines and lush rainforests to mountain peaks capped with glaciers. The park offers endless opportunities for hiking, camping, wildlife viewing, and exploring the natural beauty of the Pacific Northwest.

Beyond the national park, the area around Port Angeles is a haven for outdoor enthusiasts. Activities such as kayaking, fishing, biking, and skiing at Hurricane Ridge are popular. It also feels necessary that I mention this was one of the notable locations mentioned in the Twilight series for any “Twihards” still out there.

Port Angeles, Washington, is a highly attractive market for vacation rental investors. The typical home is valued at $390,000, with an occupancy rate of 64% showcasing the area’s consistent demand. Rentals in Port Angeles can command an average daily rate of $289, leading to great demand and an impressive average annual revenue of $47,000 for short-term rental owners.

7. Stanton, Kentucky

Stanton, Kentucky, is a small city in Powell County with a rich history and a strong sense of community. Nestled in the beautiful natural landscape of eastern Kentucky, near the Red River Gorge Geological Area, Stanton offers residents and visitors alike a unique blend of outdoor adventure, local culture, and tranquility.

Stanton is incredibly close to the Red River Gorge Geological Area and the Daniel Boone National Forest, both of which are renowned for their stunning natural beauty and outdoor recreational opportunities. These areas offer hiking, camping, rock climbing, and kayaking, making Stanton a fantastic base for nature enthusiasts and adventure seekers.

The area around Stanton and Powell County also has a rich history, with ties to early American settlers and the development of the Kentucky frontier. Local history is preserved and celebrated in community events and local landmarks.

Stanton stands out as a prime location for investment opportunities. The average daily rate for rentals is an impressive $236, leading to an average home value and annual revenue of $43,000 for homeowners. Stanton’s investment appeal is further highlighted by its AirDNA metrics, with a Revenue Growth score of 91, Rental Demand at 53, and a perfect Investability score of 100.

6. Winter Haven, Florida

Winter Haven, Florida, is a city known for its beautiful lakes, cultural attractions, and its proximity to major theme parks, most notably Legoland Florida Resort. It’s a major draw for families and LEGO fans from all over the world.

Famous for its Chain of Lakes, the city has 24 lakes connected by a series of canals. Where there’s that much water, of course it will lure the water enthusiasts with ample opportunities for boating, fishing, water skiing, and other water sports.

Aside from the Chain of Lakes, Winter Haven offers numerous parks, including the Winter Haven Garden Center and Martin Luther King Jr. Park. Outdoor activities like zip-lining, fishing, and golfing. Its mild climate allows for year-round outdoor fun.

Winter Haven is a compelling destination for investors. The typical home here is valued at $264,000, while Airbnb properties boast an impressive occupancy rate of 62%. Winter Haven’s high scores across the board highlight its revenue potential as a lucrative market for vacation rentals.

5. Sneads Ferry, North Carolina

If you’re looking for someplace with a quaint fishing village vibe, Sneads Ferry is your place. Located on the coast near Jacksonville and just a short drive from Wilmington, Sneads Ferry’s serene environment, rich history, and proximity to some of North Carolina’s most beautiful beaches make it a peaceful retreat with a variety of outdoor activities on offer to attract both residents and visitors.

Given its location on the New River and close to the Intracoastal Waterway and the Atlantic Ocean, it’s a prime spot for fishing and boating enthusiasts. The community has deep roots in the fishing industry, offering fresh seafood and opportunities for deep-sea fishing, kayaking, and canoeing.

For golf enthusiasts, Sneads Ferry offers several scenic golf courses where players can enjoy a round in beautiful coastal settings. The area’s mild climate allows for year-round golfing, making it a popular destination for golf trips.

Sneads Ferry might seem pricey with homes averaging $555,130, but with a RevPAR of $290 and a 3.3% growth rate, it’s a bet many are willing to take. It’s a stone’s throw from North Topsail Beach, offering a slice of coastal heaven. This town proves that a higher investment can lead to sweet returns, especially for those looking to cash in on the beach life.

4. Spring Hill, Florida

Located in Hernando County, along Florida’s Nature Coast, Spring Hill offers a blend of suburban living with easy access to outdoor and urban activities. It’s all about the great outdoors here, from the Chassahowitzka Wildlife Management Area to the magical Weeki Wachee Springs.

With its unique combination of unspoiled scenery, a strong sense of community, and easy access to city amenities, Spring Hill, Florida, embodies the charm of the Nature Coast. Whether you’re looking for quiet suburbia, an exciting outdoor lifestyle, or a friendly neighborhood to call your temporary home, Spring Hill delivers on that warm, diverse atmosphere.

With a Vacation Rental Demand score of 86.1, Spring Hill is Florida’s rising star. The city’s 61.7% occupancy rate shows it’s not just a seasonal fling. Spring Hill is where you can chase financial growth and soak up the sun all year round.

3. Logan, Ohio

Ohio might not necessarily spring to mind when you’re thinking about prime Airbnb locations, but you’d be surprised. Logan, in particular, is known for its breathtaking natural landscapes. Nestled in the picturesque Hocking Hills, Logan’s most famous attraction, this small town is a magnet for nature enthusiasts and photographers from all over. There are opportunities for hiking, rock climbing, zip-lining, and other outdoor activities in the region due to its lush forests and rugged terrain.

It’s not just for the outdoor enthusiast though. Logan has a rich cultural heritage, with historical sites and museums that showcase its past. The Hocking County Historical Society & Museum offers insights into the area’s history, while the Paul A. Johnson Pencil Sharpener Museum adds a quirky twist to the local cultural scene.

Not to mention it’s also conveniently located within driving distance of Columbus, Ohio’s capital. This proximity to other cities allows residents and visitors to enjoy the tranquility of the countryside while being close to the amenities and attractions of a larger city.

Logan stands out with an AirDNA score of 88 and a perfect Investability score of 100. It’s a spot where nature’s beauty meets a vibrant arts scene, keeping 57.3% of homes filled with guests. The real draw? An 18.6% Gross Yield. But, keep an eye on the zoning rules; they’re pretty particular about where you can set up shop.

2. Ellsworth, Maine

How would I describe Ellsworth? Well, in one word: charming. It has oodles of old-world charm with its historic houses and beautiful countryside to complement it. The area around this little city has so much to offer that you won’t have a very hard time filling up your itinerary.

If you’d like to travel back in time two centuries or so, you can hop on a train and ride the Downeast Scenic Railroad to get a sense of how the landscape looked back then. Or if retail therapy is more your scene, Ellsworth’s downtown boasts the largest shopping district in the county, so you won’t be left wanting for souvenirs and trinkets from your travels.

Then, of course, there’s Acadia National Park. Ellsworth sits nicely along U.S. Route 1 and takes you to the park, acting as a passage of sorts, so it’s not called the Gateway to Downeast Maine for nothing.

Ellsworth’s charm has pushed its AirDNA Score to 89.1. Its 72.8% occupancy rate speaks volumes. Yes, the entry price is steep at $324,670, but with a RevPAR of $244, the investment’s worth it. It’s all about that New England allure and the call of the wild.

1. Columbus, Georgia

Columbus has a storied past that dates back to its founding in 1828. Because it played such a significant role during both the Civil War and the Industrial Revolution, you’ll find much of its history preserved around the city.

It’s home to the Springer Opera House, a historic theater that’s still active today, as well as the Columbus Museum which is one of the largest museums in the Southeast. The National Infantry Museum and Soldier Center at Fort Benning is a state-of-the-art facility honoring the service of infantry soldiers.

Historical relevance aside, Columbus has a lot to offer on the nature front. If you’re looking for a picturesque riverfront stroll, you’ve got the Chattahoochee RiverWalk. The city also offers numerous parks, including the Columbus Botanical Garden, and outdoor activities like zip-lining, fishing, and golfing. Its mild climate allows for year-round outdoor fun. Did we mention it has the world’s longest urban whitewater course?

With an AirDNA Score of 90.2, Columbus is an investor sweet spot. The typical home costs just $160,600, and RevPAR’s growing by 5%. With nearly 60% of homes booked, it’s clear why Columbus is top of the list. Just remember, you’ll need the right permits to operate here.

Emerging Trends and Niche Markets

It’s clear that guests’ preferences for short term rentals are shifting, opening up exciting opportunities for hosts. Here’s a glimpse into the trends and niches carving out significant spaces in the short-term rental landscape.

Workations Take Center Stage

The blend of work and vacation, or “workations,” is reshaping what travelers look for in a rental. It’s not just about a bed to crash in anymore; it’s about blending productivity with relaxation. Listings that offer speedy Wi-Fi and a spot to set up a laptop aren’t just convenient; they’re in high demand. Think of your place as a retreat where guests can answer emails with a view, making it a hotspot for those who live by their laptops.

Eco-Friendly Stays Are Here to Stay

Eco-conscious travel isn’t just a trend—it’s a movement. Travelers are on the lookout for stays that reflect their green values, from renewable energy sources to recycling bins. Showcasing your commitment to the planet can make your listing a prime pick for guests who want to tread lightly on their journeys.

Unique Vacation Rentals Steal the Spotlight

The quirkier, the better. Unique stays, like tiny houses with big character or homes echoing Frank Lloyd Wright’s iconic designs, are all the rage. It’s about offering an Instagram-worthy experience that guests won’t just enjoy but will want to share. Whether it’s minimalist chic or historic charm, making your listing stand out with its distinctive style can draw in those looking for more than just a place to stay.

Tapping into these trends not only sets your listing apart but also connects with guests on a deeper level, from those seeking a scenic backdrop for their next Zoom call to eco-warriors and lovers of the unique. As the Airbnb scene transforms, adapting to these changes can keep your spot at the top of travelers’ wish lists.

Making the Most of Your Airbnb Investment

Jumping into Airbnb hosting isn’t just about having a spot to rent out; it’s about curating an experience that’ll make guests want to come back or rave about it to others. Here’s how you can really make your listing pop, stay on the right side of local laws, and keep those bookings rolling in.

Give Your Listing a Glow-Up

First up, professional photos are a game-changer. They make your space look its best and grab the attention of potential guests as they scroll. But what really sets your listing apart? Those unique touches. A hot tub, antique furniture, or a view that takes your breath away… Highlight what makes your place special. And comfort matters—a cozy living space and a kitchen that’s got everything guests might need will turn a good stay into a great one.

Stay Smart with Local Rules

Getting to grips with the local rules is crucial. Dive into the specifics of what your area allows for Airbnb hosting, from zoning laws to property taxes. Doing your homework upfront saves you a headache later on and keeps the peace with your neighbors.

Keep Those Bookings Coming

Success boils down to keeping your place booked. That means not just drawing guests in but giving them a stay they’ll want to shout about. Add those personal touches, keep your place spotless, and don’t skimp on the amenities. If your place is a short walk from the must-sees, make sure your guests know it. A personalized guide to the best local spots can make their stay unforgettable.

You’re not just maximizing your investment by nailing these areas—sprucing up your listing, playing by the rules, and delivering standout guest experiences. You’re also stepping up as a host who offers more than just a place to sleep, but a memorable slice of life in your locale. Remember, the goal is to create a space where guests don’t just stay; they live it up, love it, and leave looking forward to their next visit.

Final Thoughts

Remember, it’s not just about a place to crash. It’s about curating experiences in the best Airbnb markets the United States has to offer that guests carry way past checkout. Your spot could be the one they can’t wait to come back to, thanks to those thoughtful touches that whisper, ‘You’re home.’ We’re talking about those insider tips to the best local grub, a kitchen prepped for late-night munchies, or that snug nook perfect for some R&R.

Happy property hunt! And once you’ve got that listing secured, check out iGMS for help with all the daily to-dos.